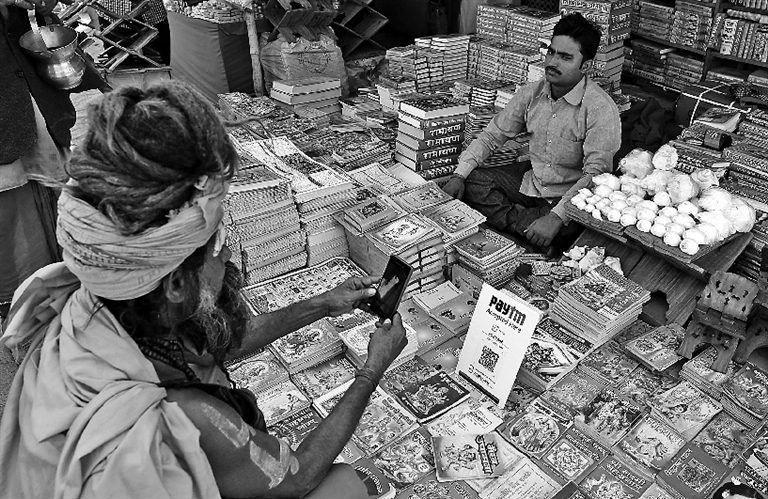

GLOBAL lenders including Citigroup and HSBC are stepping up efforts to sell day-to-day banking services to Asia’s fast-growing new technology firms, amid growing competition for more traditional transaction banking. The workaday transaction banking business, which refers to services that deal with companies’ operational needs such as trade financing, cash management and facilitating payments, has been a source of stable returns without consuming much capital for banks in Asia, the largest trading region in the world. While the impact of the trade war between China and the United States has not been felt on that business yet, analysts say the tensions have clouded the outlook for Asian economies and goods trade and made the services sector more attractive. The targets for the new initiative include e-commerce firms, mobile payment service providers and ride-hailing companies — from China’s Ant Financial and Grab in Southeast Asia to PayTM and Flipkart in India, said senior bankers and consultants. Standard trade finance business has become commoditized, and Asia is seeing rapid digitization of cash and growing demand for real-time transaction infrastructure, said Rajesh Mehta, Citi’s Asia Pacific head of treasury and trade solutions. “Cash management for e-commerce companies ... with their long distribution chains in the region is becoming a big opportunity, as these companies grow and their supply chain network becomes bigger and more complex,” he said. Citi saw revenues from its technology clients, including e-commerce firms, surging 20 percent so far this year compared with the same period last year, up from 17-percent growth in 2017, making it the fastest growing segment for the bank’s Asia Pacific treasury and trade solutions unit. The growth across banks in this segment is set to be boosted by surging transactions involving digital platforms in Asia and as many technology firms go cross-border, potentially offsetting any impact from the trade war, banking industry officials said. The digital commerce market in Asia Pacific is set to surge two-fold to reach more than US$1.1 trillion by 2022, accounting for almost two-thirds of the business globally, according to consultancy Accenture. “The big play here is how can one dominate the services economy going forward and that’s where the big battleground is,” said Mohit Mehrotra, Deloitte Asia Pacific strategy consulting co-leader. “All these trade wars are about the goods economy.” (SD-Agencies) |