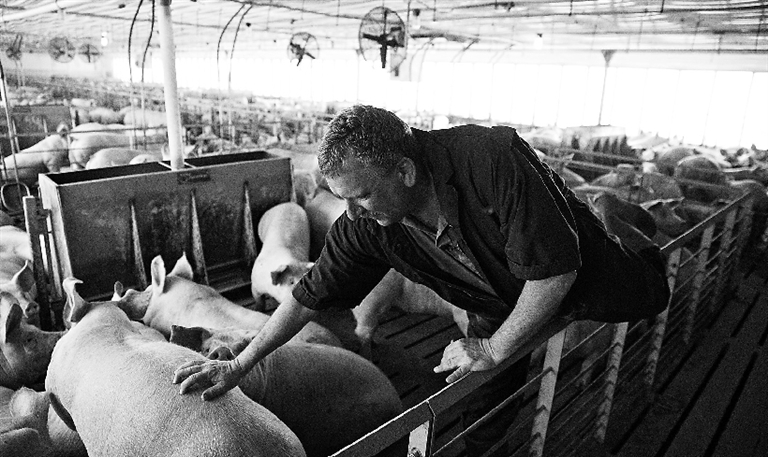

KEN MASCHHOFF, chairman of the largest U.S. family-owned pork producer, has watched profits fall as trade tensions rise between China and the United States. His company, The Maschhoffs, has halted U.S. projects worth up to US$30 million and may move some operations overseas. Investing in domestic operations now would be “ludicrous” as other countries retaliate against U.S. agricultural goods, Maschhoff said from the firm’s Carlyle, Illinois headquarters. Across the globe, Chinese pig farmer Xie Yingqiang sent most of his 1,000-pig herd to slaughter in May to limit losses after Chinese tariffs on U.S. soybeans hiked feed prices. The Sino-U.S. trade war is hurting the pork industries of both nations – and has caused damages on other major pork exporters such as Brazil, Canada and top European producers. In contrast to many industries that trade war has divided into winners and losers, the world’s pork farmers and processors are almost universally shedding profits and jobs from a crippling combination of rising feed costs and sinking pig prices. Just before trade barriers went up, the U.S. Department of Agriculture (USDA) predicted in an April analysis that global supply growth would outpace demand this year, sparking “fierce competition and lower prices.” Tariff battles accelerated those trends by shutting off export markets, raising feed prices and upending regional supply-and-demand dynamics that underpinned industry profits. “We’re keenly interested in the United States and China getting it resolved,” said Kenneth Sullivan, chief executive of Smithfield Foods, the world’s largest pork producer and a division of China’s WH Group, adding that expansion of the U.S. pork industry had also hurt profitability. The USDA said in a statement that pork producers soymeal costs have declined because of a surplus of domestic soybeans that China is no longer buying. Brazil’s pork industry has suffered higher feed prices partly because farmers now must compete with major Chinese soybean buyers who turned to Brazil to avoid tariffs on U.S. beans. In Canada, the world’s third-largest exporter, producers’ fortunes have fallen along with the United States because their prices are tied to that much larger market. In August, prices fell 31 percent less than the previous month, according to data compiled by Hams Marketing Services. In Europe, big pork exporters such as Spain and Germany, have made some additional sales to China and Mexico since the trade wars escalated this year. But the new sales have not been enough to support EU prices because of expanded domestic supply and because China bought less pork earlier this year than in past years. (SD-Agencies) |