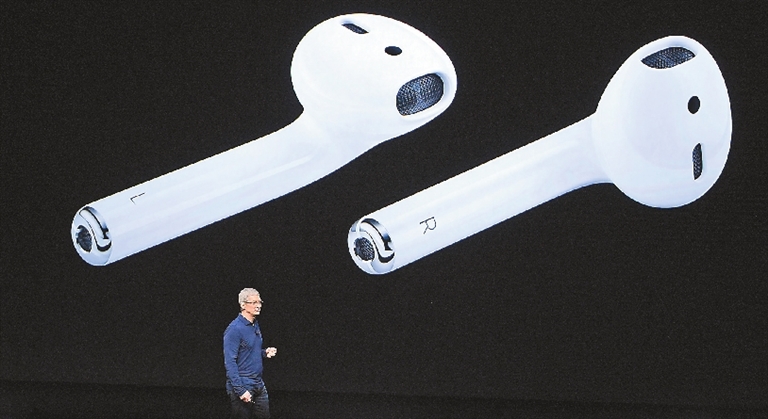

LUXSHARE Precision Industry Co.’s stock has more than tripled this year, outperforming virtually every major stock traded in the Asia Pacific and underscoring the importance of a certain Apple Inc. product the Shenzhen-based company assembles: AirPods. Commanding a 50 percent share of the nascent true wireless earphones market, defined by earbuds that have no wired connection between each other or to the music source, Apple’s AirPods have quickly become an important growth driver for the U.S. company. Wearables are Apple’s fastest-growing category, up 41 percent in 2019, and are filling in for the iPhone as the company’s growth driver for hardware sales, Bloomberg Intelligence analyst John Butler said. In 2019, AirPods are expected to double to 60 million, rising to 90 million in 2020 and 120 million in 2021, according to Credit Suisse analyst Kyna Wong. Luxshare stands to be the biggest beneficiary of that increase in production demand. It’s the fifth-best performer this year in the MSCI Asia Pacific Index and the fourth-biggest gainer on the MSCI China Index. Rival GoerTek Inc. has also surged, climbing more than 180 percent this year on optimism over stronger demand for AirPods. “Annual shipments of AirPods will rise to as many as the iPhone’s in the future,” said Jeff Pu, analyst at GF Securities. “AirPods are expected to be the biggest earnings growth driver among Apple’s hardware devices in the coming years.” Shenzhen-listed Luxshare typically produces basic tech accessories and components, such as cables, chargers and antennas. The AirPods stand out as a higher-value item, which contributed 26 percent of Luxshare’s revenue in 2018, according to HSBC analyst Frank He. He forecasts that share to grow to as high as 50 percent in 2020. He also notes that Luxshare is the sole supplier of Apple’s upgraded AirPods Pro model, launched in October, which he estimates will make up as much as 25 percent of AirPods shipments next year. While Luxshare has grabbed the largest slice of the pie so far, rivals like GoerTek are continually upgrading and vying for more of the lucrative AirPods business. The firm’s exclusivity as sole AirPods Pro supplier is unlikely to last, so it’s not guaranteed to capture all of the demand growth that’s expected. Luxshare’s unprecedented rally also means it’s now trading at a two-year blended forward price-earnings ratio of about 32, well above the roughly 24 sector average. Both Wong and He have recently upgraded their earnings estimates for Luxshare through 2021, citing the increased AirPods demand and improved average selling price. In a research note from Nov. 18, Goldman Sachs analysts including Verena Jeng agreed, saying “the higher average selling price coupled with strong market demand from a low base make AirPods Luxshare’s major revenue and gross profit contributor.” (SD-Agencies) |