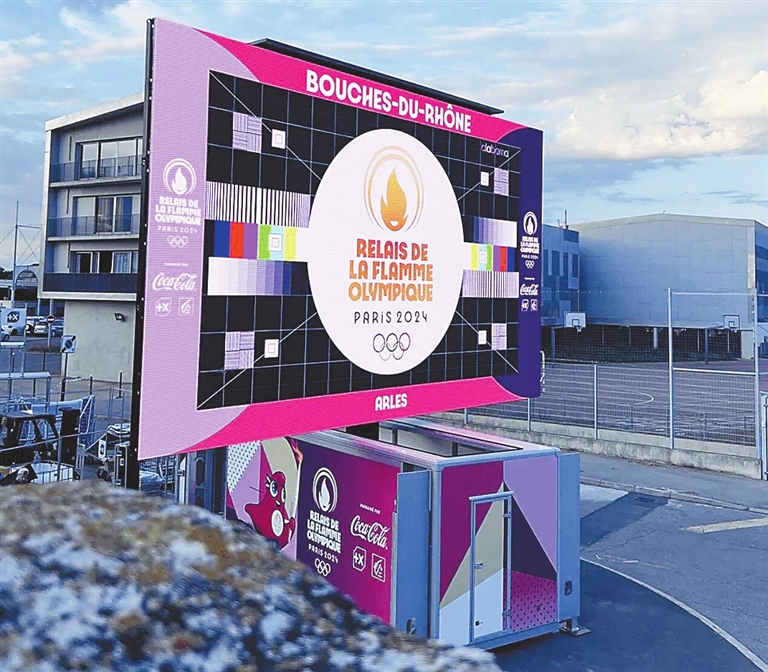

Liu Minxia mllmx@163.com IN the early hours of July 27, the opening ceremony of the Paris Olympics dazzled along the picturesque Seine River, marking the first time in modern Olympic history an opening ceremony was held in an open-air urban setting. Athletes glided on boats, passing iconic Parisian landmarks like Notre-Dame Cathedral and the Louvre Museum before reaching the Trocadéro, with the Eiffel Tower serving as a stunning backdrop. To ensure spectators lining the 6-kilometer procession route along the Seine could catch every moment of the opening ceremony in real time, the Paris Olympic Organizing Committee placed 80 massive LED screens and accompanying speakers along both riverbanks. Among the suppliers was Shenzhen Absen Optoelectronic Co., a prominent LED display manufacturer based in Longgang District. Established in 2001, Absen, an LED display company with a robust international presence, provided over 50 LED screens to the ceremony and various Games venues such as the Bercy Arena and the Stade de France. The Paris Olympics adds to Absen’s stellar track record of supplying global events. According to Absen’s 2023 financial report, its products are sold in over 140 countries and regions across five continents. The company has a notable presence at events like the World Cup and NBA games and in renowned locations such as New York’s Times Square, Hollywood, and Disney theme parks. Absen’s dominance in the LED display market was evidenced by market research firm Omdia, which ranked it first in global LED display shipments in 2023, with a substantial market share of 16.2%. Going global In the late 1990s, LED displays surged in popularity. They found widespread use in various applications, including advertising, sports venues, commercial displays, traffic signs, and stages. Back then, companies like Belgium’s Barco and the United States’ Daktronics dominated the global LED market while China’s LED industry was nascent, with small factories in the Pearl River Delta region assembling basic LED components. Ding Yanhui, Absen’s co- founder, ventured into the industry after graduating in 1996, drawing from the experiences he gained while working at a small electronics factory in Shenzhen. Recognizing the sector’s immense growth potential, Ding, armed with hands-on LED assembly expertise, co-founded Absen in 2001 with two friends. Ding didn’t pay much attention to overseas markets until 2005, when a Middle Eastern buyer visited the Absen booth at the 98th China Import and Export Fair, also known as the Canton Fair, in Guangzhou. “At that time, our annual sales were just over 6 million yuan (US$826,200). The Middle Eastern client placed an order worth 60,000 yuan and paid in cash in U.S. dollars right on the spot,” Ding recollected. This unexpected transaction prompted Ding to look to overseas markets and shift the company’s business focus abroad. Yet, the overseas market was dominated by established giants like Barco and Daktronics. According to Zhao Yang, vice president of Absen, Barco and Daktronics were both strong in technology and production, with sales networks spanning the globe. In comparison, Absen imported key components at that time due to the lack of core technologies. “This pushed up the costs and constrained our production capacity,” Zhao said. Despite initial challenges, Absen’s strategy of heavily investing in research and development to enhance its core technologies bore fruit. As a result, the quality of the firm’s products rivaled and even surpassed international competitors while maintaining cost efficiency. Absen now has a 370-member R&D team, which accounts for 13.64% of its workforce. In the past three years, the company spent a total of more than 400 million yuan on R&D. The company had applied for more than 890 patents by the end of last year, including 187 invention patents. Last year, it rolled out 55 new products. Last October, a smart manufacturing center the company built in Huizhou with a total investment of more than 1 billion yuan began operations, enabling it to realize the digital and intelligent management of the whole manufacturing process. Navigating challenges Absen’s journey abroad was not without setbacks. In 2018, U.S.-based Ultravision Technologies initiated a “337 investigation” against multiple Chinese LED companies, including Absen, alleging patent infringement. At that time, Absen derived 79% of its revenue from overseas markets, with 23% coming from North America. The investigation had the potential to result in the exclusion or prohibition of Absen’s products in the U.S. market. Absen swiftly responded, and in 2021, a federal jury in the United States District Court for the Eastern District of Texas determined that all asserted patent claims were invalid. “We decided to fight this lawsuit not only to prove our innocence but also to demonstrate to our overseas customers that we, a Chinese company, have the strength to compete in the global market,” said Zhao. Towards Paris Olympics With 18 global subsidiaries, over 6,000 partners, and more than 60,000 application cases worldwide, Absen reported that its 2023 revenue exceeded 4 billion yuan, with over 60% derived from international markets. Deng Hanqing, Absen’s vice president and product line manager, expressed no surprise at Absen’s involvement in the Paris Olympics, citing a decade of activity in the French market. The firm’s successful localization efforts, coupled with a robust brand presence in France, made Absen prominent in various sectors, from sports venues to fashion events and cultural events like the Cannes Film Festival. |