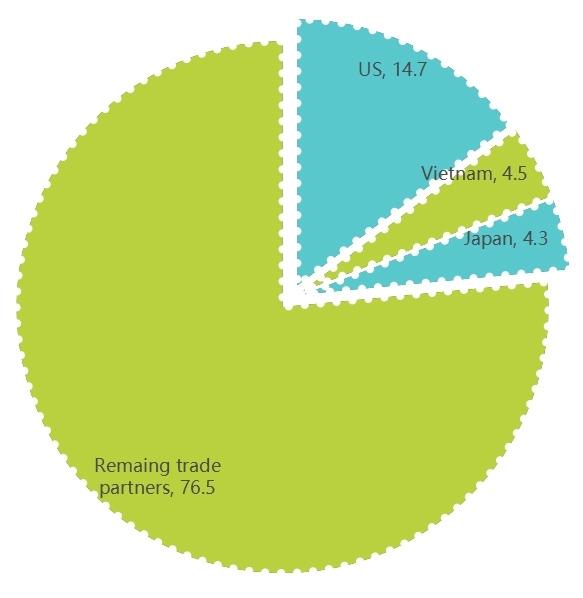

AT the Yantian Port in Shenzhen, Lin Risheng’s voice often grows hoarse after many hours of coordinating operations. Sometimes, the batteries in his walkie-talkie run out of power before the day is done. The bustling port handles more than a quarter of China’s exports to the United States and now dispatches an average of six U.S.-bound cargo ships each day. The intensity of Lin’s workday reflects the revival of trade flows across the Pacific. Trade between China and the United States is experiencing a powerful resurgence as tariff reductions have reignited cross-Pacific commerce, which is mutually beneficial in nature. Orders surge Following the release of a joint statement on the China-U.S. Economic and Trade Meeting in Geneva on May 12 and the implementation of mutual tariff reductions May 14, Chinese exporters have witnessed a surge in U.S. orders — a swift, active market response to the bilateral consensus. Just two hours after the joint statement’s release, Shenzhen Sky Dragon Audio-Video Technology Co. Ltd. received multiple urgent emails from U.S. clients requesting expedited delivery. “Our partners, including intermediaries and U.S. end retailers, are celebrating the tariff cuts,” said Xiang Congli from the company’s sales department. Businesses on both sides of the Pacific are resuming trade activities that had come to a halt due to exorbitant tariffs. U.S. companies are increasing inventory purchases while Chinese export firms are reestablishing their production of goods destined for the U.S. Behind this frenzy is what many in the business sectors on both sides view as a shared expectation of mutually beneficial cooperation. After the U.S. announced tariff hikes in early April, many American companies didn’t cancel orders but instead delayed the trade process. “Now that China and the United States have agreed to lower tariffs, we’ve just released a series of purchase orders to our Chinese suppliers,” said Tom Simon, head of design and product development at Juniper Design Group Inc. This renewed confidence extends to manufacturers across China. In northern China, Shanxi Dahua Glass Industrial Co. Ltd., which exports about 40% of its annual production to the United States, has resumed crafting glass bread trays for U.S. department store chain Macy’s. “We had to pause and restart due to the tariff shifts. It felt like riding a roller-coaster,” said deputy general manager Liang Wensheng. Chain effects On one side, Chinese factories are working to get backlogged orders and inventories moving again. On the other, U.S. buyers are continuously placing new orders in anticipation of the back-to-school and holiday shopping seasons in the second half of the year. Hu Ran, founder of a Seattle-based lighting company whose products are designed in the United States and manufactured in China, said the company is rushing to import more goods from China. The order surge has revitalized the logistics networks between the two major economies. According to container-tracking software provider Vizion, container bookings from China to the U.S. skyrocketed nearly 300% immediately after the tariff reductions took effect. Before the tariffs were lowered, some of the China-U.S. shipping routes had been suspended or redirected to South America or Europe. Bookings have resumed recently, with shipping companies reinstating former routes and deploying additional vessels to meet surging demand. Eve Tang, a trucking business owner in Los Angeles, noted that in recent weeks, as Chinese exporters have gradually resumed shipments to the U.S., the U.S. inland transportation market has also become busy again. “We expect this rebound to last one or two weeks, or even longer, though uncertainties for the future still remain,” Tang said. Beyond the immediate export revival, a growing number of Chinese export companies have come to a common understanding. First, superior product quality and innovation will continue to create market opportunities. Second, a solid industrial and supply chain foundation helps to navigate the complex and changing international trade environment. “The current surge in export volume and positive market response clearly demonstrates the strong foundation and powerful competitive edge of Chinese manufacturing,” said Zhang Guangyang, general manager of Shenzhen Huitong Tianxia Logistics Co. Ltd. Cautious but confident Many Chinese exporters welcomed the results of a recent China-U.S. high-level meeting on bilateral tariffs, although they remain cautious about a full rebound in exports to the United States. At Yiwu, a renowned global trading hub known as the “world’s supermarket,” glasses manufacturer Chen Haihong received messages from her American clients to resume the canceled orders right after the joint announcement of tariff modification. She said the company plans to continue expanding in the U.S. market while diversifying its product range, exploring opportunities in other countries, and growing through both online and offline channels. Helen Wang from Huahong Art Home Shares is optimistic that Chinese businesses will adapt. “The spirit of Yiwu is about a fearless attitude toward hardship, a keen sense of market trends and rapid response, and the agility to adapt and transform with speed,” said Wang. Chen Yongjun, a professor at Guangdong University of Finance and Economics, noted that the United States remains one of the major trade partners of China. China's exports to the United States represented 14.7% of the country's total in 2024, lower than the 19.2% recorded in 2018. Official data showed that Guangdong, as China's largest foreign trade province, sold 948.81 billion yuan (US$131.65 billion) worth of products to the United States last year, with the proportion of exports to the United States having fallen to 16.1%. The tariff reductions would help promote trade expansion between the two nations, said Chen. He urged domestic manufacturers to further improve product competitiveness and diversify their global market presence while increasing their presence in the U.S. market.(Xinhua) |